Understanding the politics behind a Greek exit of the Euro

(8 Nov 2011)

So what were the dilemmmas examined ?

Euro workshop in play 2011

So that's what we did. At the workshop participants role played the important parties involved,.

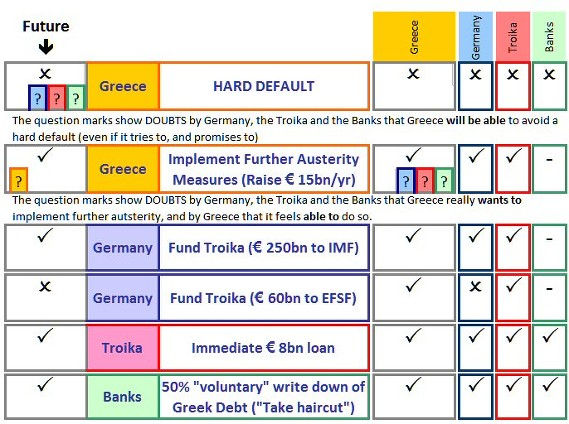

THE MAIN DILEMMA was that Greece was looking as if it would default on a bond repayment that was coming up shortly. In other words it needed a loan to pay off the loan, would anyone give Greece a loan that it probably wouldn't be able to repay? Greece did not want to default, but many observers knew that if nothing was done by anyone then it might have to, if it wanted to or not. Everyone wanted to avoid that happening. This is the dilemma driving the Eurocrisis.

Greece was also promising to try to pay back its loan by implementing more austerity measures. Here people doubted if the Greek government was really willing to do this, or if it was just saying it would. The Greeks were also in a quandary as they did not know if they could actually do this without civil unrest perhaps toppling the government.

Germany was the country that was footing the bill it was the one lending money to the Troika. At the time of the workshop, Germany was willing to lend to the IMF, but not lend to the EFSF (European Financial Stability Fund)

The Troika - the European Commission (EC), the International Monetary Fund (IMF), and the European Central Bank (ECB)also had to fund an immediate 8bn loan to Greece, all the parties agreed this should happen, if somewhat reluctantly.

The Banks were reluctantly willing to accept a 50% haircut (cancellation of their debts), so that Greece would be in a position to pay back the rest of their debts

What happened in the workshop?

Dilemma Analysis

What is FASCINATING about this from a dilemma analysis perspective is the lengths to which countries were willing to go to so they can ELIMINATE their dilemmas. The banks agreed to a 50% haircut, this means that THEY HAVE LOST 50% OF THE MENEY OWED TO THEM, but they are willing to do this if they can SAY that Greece technically has not defaulted. In reality they have. They have broken the agreement they made when they took out the loan. Investors will not get their money back, but people seem to care much less because they have avoided the DILEMMA of Greece technically defaulting.

This shows the power that dilemmas have. Here TENS OF BILLIONS of Euros are surrendered, but people mind less as the dilemma of a "The Greeks default " is being avoided.

One of the advantages of Dilemma analysis using a Decision Workshop is that by recording changes to the options table, the progress of the workshop can be easily recorded, in a step by step manner. The changes that had happened by the end of the Eurocrisis workshop are highlighted in yellow below:

What actually happened ?

Basically most of the things predicted in the workshop took place

Looking at things a year later (November 2012) we have the following situation:

1) As in the workshop, Greece has not TECHNICALLY defaulted on its Debts, but the banks have taken a 50% haircut.

2) As in the workshop, the Greeks have not left the Euro, and have continued to try to maintain their austerity package, despite much public protest.

3) As in the workshop, the holders of Greek debt did accept the 50% (actually 53.4%) "haircut".

4) As in the workshop, the Greeks "cheated" by using Emergency Liquidity Operations to finance their banks. and , also as in the workshop, nobody has really complained about it. Six months later the Financial times ran an article describing a huge increase in this activity (right).

5) The Europeans organised the European Stability Mechanism launched in Sept 2012 (although providing only € 500bn not € 2,000bn), effectively this was the "mechanism of providing money to protect the banks from defaults", mentioned in the workshop. The ESM lends to governments, but in practice much of the loans are passed by governments to their national banks.

6) There are now plans for a European Banking Union involving Mutual Pan-European Deposit insurance, and bank recapitalisation. This is meant to act for banks in the same way as the ESM acts for governments.

7) In the year since the workshop Greek debt has intermittently been used as collateral and has been suspended a couple of times.

Graph taken from Financial Times of May 21 2012 (six months after the workshop) showing huge increase in Greek ELA as forecast in the workshop.

What happened was that everyone conspired to keep the Greeks from leaving, The Greeks "cheated" on their promises by taking Emergency Liquidity Assistance (to which everyone turned a blind eye) and the ECB eventually succeeded in forging a mechanism acceptable to the Germans to get large amounts of cash to undewrite the Greek debt.

In November 2011 the crisis in the Eurozone was at one of its many peaks, with Greece moving to the edge of default. The threat of economic meltdown, had captured the attention of the economists, bankers and consultants of the world.

Everyone was awaiting the next move with trepidation, and attempting to second guess the sequence of future events that would unfold …. what would they be?

The airwaves and the internet were awash with ideas and forecasts of future scenarios, sometimes radically different. Chat shows were full of informed, confident “experts” disagreeing with one another about what should happen and what would happen. With such disagreement, how could you have chosen who to believe?

The answer is that research shows that if people role play the parties involved in a confrontation, then they not only gain great insight into the situation, but also are more likely to produce an accurate forecast of what will actually happen than using other methods. Such workshops can be used to test out and refine strategies.